idaho tax refund schedule 2021

Idaho income tax withheld. You dont need to do anything.

Idaho Tax Rebate 2022 When Can You Expect Your Idaho Tax Refund Marca

Download or print the 2021 Idaho FORM 24 Idaho Grocery Credit Refund for FREE from the Idaho State Tax Commission.

. Idaho income tax withheld. Enter the original refund amount. Tax from tables or rate schedule.

Form 39R Resident Supplemental Schedule 2021 approved Author. Due the 15th day of the 4th month following the close of the fiscal tax year. Idaho State Tax Commission issues most refunds within 21 business days.

Well apply your rebate to your 2021 tax after weve processed all payments received in April. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012. The deadline to submit your tax return and pay your tax bill is April 15.

Check the amended filing box if applicable. Tax Return Accepted By IRS Refund Status Approved by IRS Direct Deposit Sent Paper Check. Special fuels tax refund Gasoline tax refund Include Form 75.

Click Search to view your refund status. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn how to only prepare and file a ID state return. Due the last day of February.

Resident Supplemental Schedule 2021 approved Extracted from PDF file 2021-idaho-form-39rpdf. Idaho Income Tax Rate 2020 - 2021. Details on how to only prepare and print a Idaho 2021 Tax Return.

I filed my 2021 tax return and want my rebate to apply to the tax I owe. We will update this page with a new version of the form for 2023 as soon as it is made available by the Idaho government. The Idaho income tax rate for tax year 2021 is progressive from a low of 1 to a high of 65.

Due the 20 th day of the month following the tax period the tax period may be monthly or quarterly Federal Form 1099 to Tax Commission. You may check the status of your refund on-line at the Idaho State Tax Commission. The Idaho State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Idaho State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Residents of Massachusetts and Maine. Include federal Schedule C or C-EZ. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Idaho State Income Tax Forms for Tax Year 2021 Jan. Age as of the last day of 2021. To check the status of your Idaho state refund online visit this website.

If you dont have access to a computer call 208-334-7660 Boise. Individual Income Tax Rate Schedule. Which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not cover the taxpayers entire liability.

Calculate your tax rate based upon your taxable income the first two columns. Corporate income tax returns. The IRS will begin accepting and processing returns Jan.

E-File Check in Mail. Due April 15 for calendar year filers. The personal exemption was eliminated starting in the 2019 tax year just as they were with federal income taxes.

The median annual income in Idaho is 55785 according to data from the US. The IRS e-File open date is Jan. All sources while an Idaho resident.

Enter your Social Security number or ITIN. State income tax refund. Idahos state sales tax is 6.

Estimated Federal Tax Refund Schedule. Find IRS or Federal Tax Return deadline details. See instructions page 27.

Printable Idaho state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. Free classes many topics. See instructions page 53.

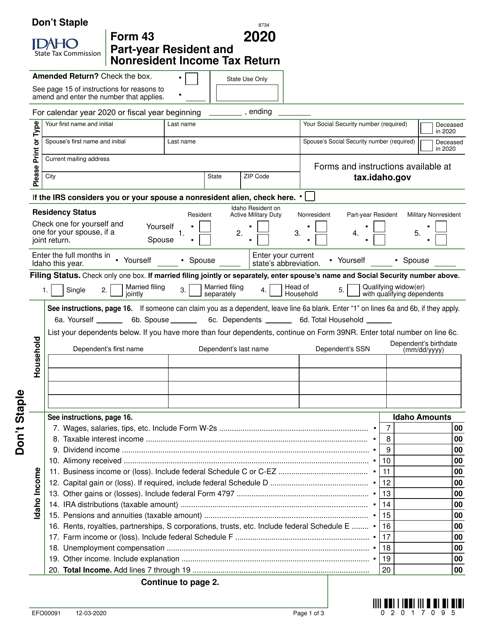

Refund Info and Status. The Idaho tax rate is unchanged from last year however the. Form 43 Part-year Resident and Nonresident Income Tax Return 2021 approved Author.

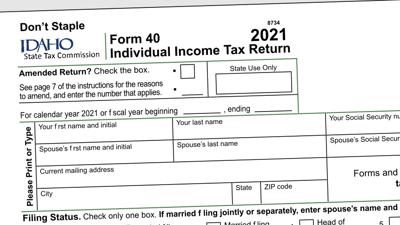

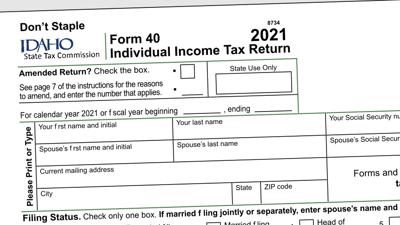

We last updated Idaho FORM 24 in January 2022 from the Idaho State Tax Commission. Form 40 Individual Income Tax Return 2021 approved Author. Which will result in either a tax refund of excess withheld income or a tax payment if the withholding does not.

Your Idaho drivers license number state-issued ID number or 2021 Idaho income tax return. 2022 Tax Refund Schedule 2021 Tax Year Note. Idaho State Tax Commission Keywords.

Business income or loss. Idaho state legislators in May approved a bill that cuts 3829 million in income taxes to residents which included 220 million in one-time income tax rebates for residents and businesses. Part-year Idaho residents must file if their total gross income from the following sources combined is more than 2500.

However taxes for 2021 must be filed by April 18 2022 due to a legal holiday in Washington DC. That income level would see a 328 rebate and about a 113 ongoing tax cut assuming the individual. What do I need to do.

These back taxes forms can not longer be e-Filed. Download or print the 2021 Idaho FORM 39R Idaho Supplemental Schedule Resident for FREE from the Idaho State Tax Commission. The Idaho Department of Revenue is responsible for publishing the latest Idaho State.

Form 43 is the Idaho income tax return for part-year Idaho residents. You can start checking on the status of your return within 24 hours after they have received your e-filed return or 4 weeks after you mail a paper return. Select ID type from the drop down.

Below are forms for prior Tax Years starting with 2020. Idaho State Income Taxes for Tax Year 2021 January 1 - Dec. Resident Supplemental Schedule 2021 Names as shown on return Social Security number A.

The Idaho tax filing and tax payment deadline is April 18 2022. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Idaho state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with ID tax rates of 1125 3125 3625 4625 5625 6625 and 6925 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Special fuels tax refund Gasoline tax refund Include Form 75. Instructions are in a separate file. The standard deduction is equal to the federal standard deduction which for the 2021 tax year is 12550 for single filers and 25100 for joint filers.

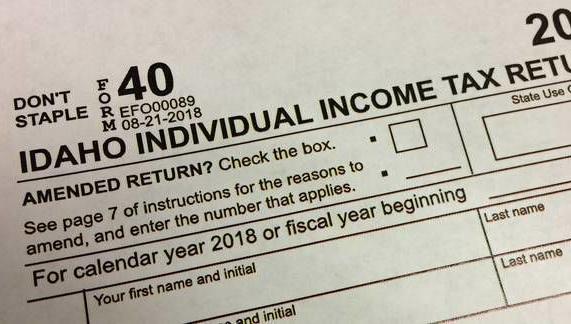

This is the rate you. Other Idaho Individual Income Tax Forms. Idaho state income tax Form 40 must be postmarked by April 18 2022 in order to avoid penalties and late fees.

Paper File Direct Deposit. You can try to extrapolate the refund date based on the below chart.

Idaho State Tax Commission Forms Pdf Templates Download Fill And Print For Free Templateroller

Connecticut Tax Forms And Instructions For 2021 Ct 1040

Idaho Tax Forms And Instructions For 2021 Form 40

Waiting For Idaho Tax Refund You May Still Need To Complete An Important Step Idaho Bigcountrynewsconnection Com

Have You Sent Your Idaho Tax Return But Haven T Received A Refund This Could Be Why East Idaho News

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

When To Expect Your Idaho Tax Refund Fingerlakes1 Com

Idaho Income Tax Rates For 2022

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes East Idaho News

Where S My Refund Idaho H R Block

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

Want To Track Your 2022 Tax Rebate Check Out This Tool From The Idaho State Tax Commission Idaho Capital Sun

Here S The Average Irs Tax Refund Amount By State

Prepare And E File 2021 Idaho State Individual Income Tax Return

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Here S The Average Irs Tax Refund Amount By State Gobankingrates

2022 Tax Filing Season Begins January 24 Idaho Bigcountrynewsconnection Com

Idaho Residents Start Seeing Tax Relief Money

Waiting For Idaho Tax Refund You May Still Need To Complete An Important Step Idaho Bigcountrynewsconnection Com